Critical Illness Coverage

When you’re diagnosed with a critical illness, such as heart disease or cancer, the last thing you want to think about are your finances. Having a health insurance plan is no guarantee that all your medical expenses associated with your illness will get covered. If you have a policy with a high-deductible, you could end up paying thousands of dollars before meeting your deductible.

When you’re diagnosed with a critical illness, such as heart disease or cancer, the last thing you want to think about are your finances. Having a health insurance plan is no guarantee that all your medical expenses associated with your illness will get covered. If you have a policy with a high-deductible, you could end up paying thousands of dollars before meeting your deductible.

Critical illness plans are designed to give you financial security and peace of mind so you can concentrate on getting well. Treatment costs associated with cancer, stroke or heart disease are high. A critical illness insurance policy will help pay for both medical and non-medical expenses you’ll incur on your road to recovery.

Coverage for a Range of Medical Treatment

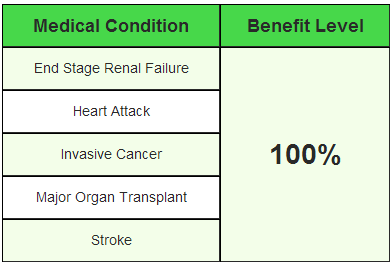

Once you are diagnosed with a critical illness, the policy will pay out a one-time cash benefit up to 100% of the plan’s maximum benefit. The benefit level will vary depending on the medical condition.

Major medical conditions have the highest payout.

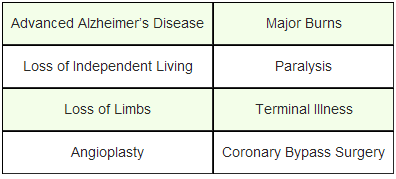

Other conditions and procedures are also covered but payout benefits might vary depending on the carrier and plan type.

Help When You Need It The Most

- Coinsurance, copays and deductibles

- Doctor visits

- Diagnostic procedures

- Transportation fees to a medical facility

- Home health care

- Caregivers

- Rehabilitation

- Prescription drug costs

Household Bills

Lost Income

Gas and Food

Mortgage Payments

Although health, life, accident and disability insurance offer important coverage, critical illness plans can offer unequalled financial protection. Critical illness insurance plans help fill in the financial gaps not covered by those other types of plans.

Colorado Bankers Life is an affiliate of Dearborn National Insurance Company and offers competitive critical illness plan options to Coloradans.

Assurity is an A-rated insurance company by A.M. Best. Assurity Life Insurance Company offers critical illness plans to pay for unexpected financial hardships resulting from a critical illness or injury.

Humana — One of the largest health insurance companies in the country, Humana also provides exceptional critical illness coverage to individuals and families.

Health Insurance Instant Quote

HEALTH INSURANCE INFORMATION

- Plans approved and authorized under the Affordable Care Act

- Covers Pre-Existing conditions

- Low cost subsidized plans available to those earning

< 400% of the federal poverty level - Unlimited lifetime benefits

- Available during open enrollment (November 1 – January 15), or if you qualify for a Special Enrollment Period

Healthshare Instant Quote

HEALTH COST-SHARING INFORMATION

- Not health insurance, but a way for like-minded individuals to share medical expenses

- Waiting periods on pre-existing conditions

- May exclude sharing for certain conditions or activities

- Enroll any time

- Much lower monthly cost than unsubsidized health insurance